How to Stop Rental Fraud Before It Starts

Smarter Self-Showing Fraud Detection for Property Managers

A Story That Could Happen to Anyone

Imagine this: A property management team thought everything was running smoothly with their self-showing homes. Then the worst happened and they realized how exposed they were. A renter lead looked good on paper - passed basic checks, uploaded a photo ID, even used a real phone number. But also, they booked multiple tours at the same time. The system, promoted as having world-class fraud detection, completely missed it. Days later, appliances were stolen from several units. What seemed like a smooth process was actually a huge security gap.

Hopefully that doesn’t sound familiar to you! But, rental fraud is exploding everywhere, and self-showing scams are a big part of it. Property managers are seeing more fraud, fake IDs, and theft because verification and oversight are often lacking. Even big companies have taken serious hits when basic checks were skipped or turned off.

The Rising Challenge of Renter Fraud

Working with property management teams nationwide, I've seen firsthand how common and quickly this problem can escalate without the right systems. Many modern self-showing tools boast about their fraud detection, but often fall short. The real challenge isn't just finding the tools; it's knowing what's out there, whether your current systems already have these features, and getting over the fear that extra checks will "scare off" good renters.

Here's the thing: good systems do add a little friction, and that's totally fine. A few smart speed bumps are exactly what keep your properties safe and your team focused on real prospects, not dealing with bad actors. Trust me, a small inconvenience now is way better than the huge headaches and costs of actual fraud later.

Why Smart Detection Layers Are Your Best Friend

Every fraudulent inquiry that slips through costs your team time, your owners peace of mind, and your business money. Catching fraud at the registration stage gives you control before anyone gets access, protecting both your owners' assets and your bottom line. Think of it as your personal pre-tour firewall: data validation, identity checks, and location awareness all working together to stop problems before they even hit your calendar.

Rental fraud prevention works best when you have multiple checks that overlap, each verifying a different part of the process. Here are some key layers:

Enhanced ID Verification (AMVA Check): This scans and validates IDs using barcode and AMVA data to confirm they're authentic. It makes sure the ID is government-issued and real, not some printed fake.

Likeness Check: Requires a live selfie that's compared to the uploaded ID photo. Tools like Persona provide tools to verify the potential renter is actually who they say they are, stopping impersonation right from the start.

Duplicate Booking Detection: This flags multiple tour requests or overlapping schedule times from the same person, device, or contact info. It's great for catching organized scams and repeat attempts that might otherwise slip by.

IP Address Verification: Checks the device’s IP address for where it's coming from and if it has any known risk profiles. This helps spot remote or masked access patterns often used by fraudsters.

Phone Verification (No VOIPs!): Confirms the phone number is active, valid, and not a temporary VOIP or masked line. This keeps throwaway numbers out of your communication.

Phone Reputation Scoring: Tools like Forewarn look at behavioral data and fraud databases to score how trustworthy a number is. They flags numbers linked to past scams or suspicious groups of leads.

Payment or Bank Verification: Verifies an active payment method or bank account, even with a small transaction. This adds financial proof that the applicant is a real person with a verifiable identity.

Seriously, a little friction at the right moment makes a huge difference. Each extra check reduces your risk and helps your team focus on the good renters.

Where These Checks Fit Into Your Day-to-Day

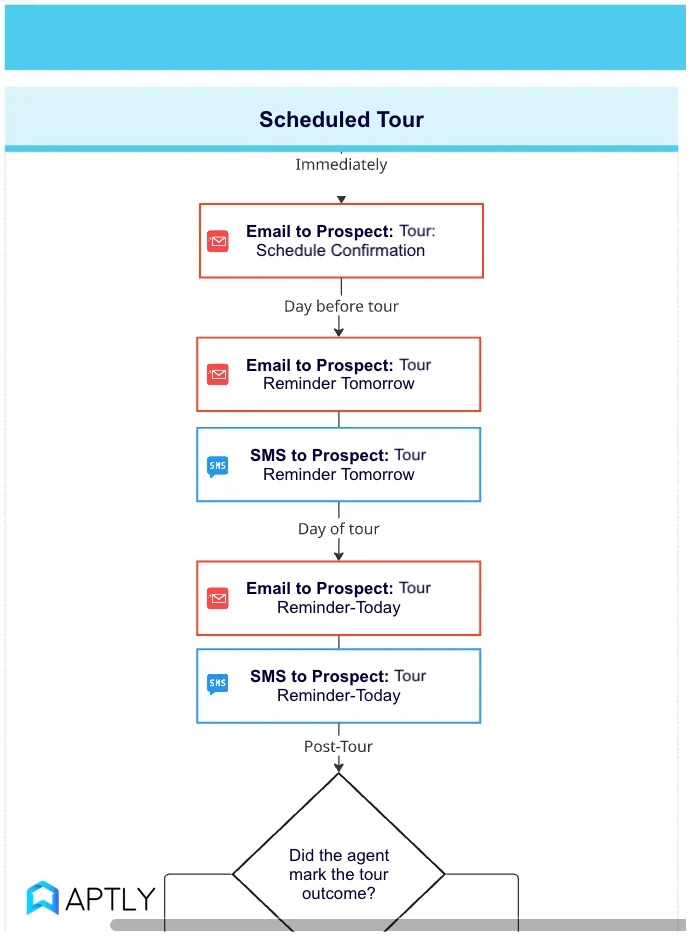

Good news! Several of these features may already exist in your current systems; but might not be turned on. Here’s how we typically fit into a smooth Leasing CRM workflow:

Lead Capture: A new inquiry comes into your CRM or showing platform.

Automated Verification: ID, likeness, phone, and IP checks run quietly in the background.

Manual Review for Exceptions: If anything looks off or incomplete, your staff gets a quick alert for review before a showing is approved. You can add manual exception checks at this point (including tools not already available in your current showing-service solution).

Tour Approval and Access Code Generation: Only verified leads get the green light for self-showings, and access codes are generated right at the property door after a final check.

When automation handles the screening, your team can focus on what matters: real prospects. Plus, your process stays consistent, no matter who's working.

Picking the Right Setup for You

Most property managers already juggle a bunch of tools for leads, screening, and showings. The big question is: do those systems actually have enough fraud detection, and are they set up right to deliver on that promise, instead of just collecting data?

Ask yourself these key questions about your current setup:

What verification layers are available, and which fraud detection options make sense for your operations?

How does information flow between your CRM, showing system, and screening provider? Is it seamless?

Do you get alerts and flags for manual review when potential risks pop up?

Are your systems automated to catch fraud in real-time, while still allowing for quick approvals and manual checks when needed?

It's not just about what your software can do; it's about what you've chosen to activate. Tweaking a few settings can be the difference between a smooth operation and a costly mistake.

If you're feeling a bit lost, it helps to chat with someone who's been there and configured these systems before. Our property management consulting services can help you evaluate, select, and implement the best fraud prevention tools for your business.

The right setup doesn’t make your job harder; it makes your systems work smarter.

The Story's End

Remember that property management company from our story? They ended up needing a complete system overhaul. They moved to a platform that offered layered verification, real-time checks, and clear paths for flagged tours. They switched to Aptly Access, which also brought lock management and fraud detection together in one integrated workflow. With the new system, fraud attempts dropped immediately, and legitimate renters still moved through the process smoothly.

Sometimes the system isn’t broken; it just isn’t built to protect you.

Final Thoughts

Preventing fraud isn’t about keeping good renters out; it’s about adding the right level of verification to let the right people in. A little friction is just a normal part of a healthy, safe, and professional process.

If you're wondering if your current workflow has the right checks in place, or if those features are even turned on, now's the time to take a closer look.

Ready to boost your property’s security and make your screening process smoother?

Let’s chat! We can help map out your process, spot any gaps, and build a smarter, safer screening workflow that balances security with speed. Contact us today for a consultation!